- 2018 best expense tracker app for android update#

- 2018 best expense tracker app for android android#

- 2018 best expense tracker app for android software#

- 2018 best expense tracker app for android free#

This may make some users uncomfortable, although the application is read-only so no payments, withdrawals or transfers can be made from accounts.

2018 best expense tracker app for android software#

Like OnTrees, you need to enter your bank login details for the software to read your bank statements. Wally is available for iOS and Android, but there’s no desktop version.Īnother app that shows you all your account balances in one place. Notifications will remind you of upcoming payments and when you have reached a savings goal.

2018 best expense tracker app for android update#

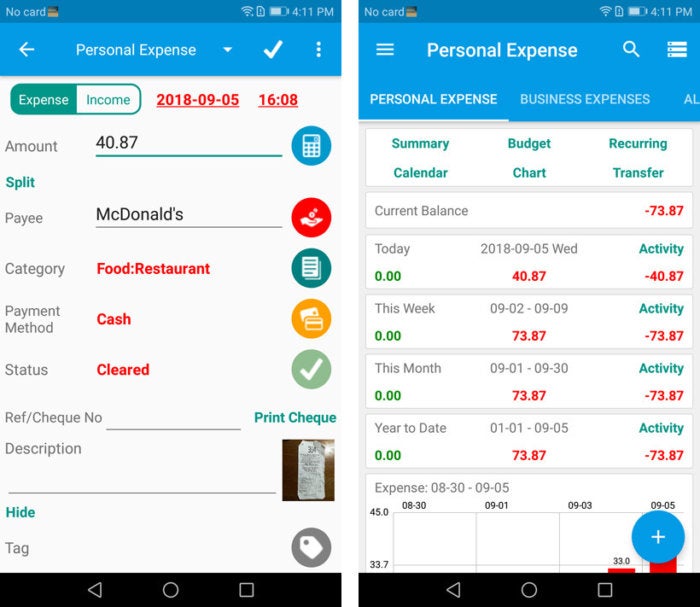

Another feature is the ability to photograph your receipts to update your spending and expenses. Wally also works with smartphone location services to track where you’re spending your money.

2018 best expense tracker app for android free#

Its developers claim the free app offers a “360-degree view” of your money, tracking what comes in, what goes out, what you have saved and what you have budgeted.

2018 best expense tracker app for android android#

Developers are working on Android and Windows apps. OnTrees is free but only available for desktop and iOS. You don’t have to enter transactions manually as it sorts your bank and credit card transactions into categories. Unlike YNAB, which is focused on planning ahead and recording every penny you spend, OnTrees concentrates on where your money has gone. It’s a read-only service, which means it cannot be used to move money in or out of accounts. Wally claims to offer a 360-degree view of your money, tracking what comes in, what goes out and what you have budgetedīought by financial website MoneySuperMarket in 2014, the app, or desktop version, lets you view all your bank accounts from different providers in one place with one login. It’s available for iOS, Android and desktop. There’s a free version of Goodbudget and a “Plus” version with more features for $5 (£3.50) a month. Envelopes and balances can be synched between different devices and other people – useful to work out the household budget with your other half. You can check your envelope balances as well as your bank balances, and expense tracking is also available. Previously called the Easy Envelope Budget Aid, Goodbudget is another app based on the “envelope budgeting method” – dividing your cash into pots of money for different things. But the phone app is handy to keep track of spending while you’re out and about. Nor is it, strictly speaking, an app: it is desktop software with an iOS or Android smartphone app running alongside it. It costs $5 (around £3.50) a month or $50 (£35) a year with a 34-day free trial. YNAB also encourages users to save money each month for larger expenses such as car insurance or birthday gifts. If you over- or under-spend in an area you can move money to another pot. Users divide their income into separate pots, such as rent or groceries, when they get paid, and every pound is accounted for. Its mantra is “give every dollar a job” (it is American but you get the option to work in pounds). YNAB is a digital take on the concept of having pots of money for different things. YNAB makes the bold claim that after nine months the average user will have saved more than $3,300 (around £2,326). There’s quite a buzz about YNAB in tech circles, with plenty of “lifehacker” articles tipping it as the standout budget app. But are they worth using? Guardian Money put them to the test. Unfortunately, they aren’t all free – so your budget may have to include spending oney on an app.

They track your spending closely and alert you when you’re going wrong, with some claiming to save you thousands. They all claim to be simple to use, and are not just for geeks.

But there are a string of smartphone apps that could make the task of staying in the black that little bit easier. With average wages still below where they were eight years ago, it’s hardly surprising so many people, particularly the young, struggle to make ends meet. T he lives of millions of people in Britain are so precarious that a third of families would have trouble finding £500 for an emergency bill.

0 kommentar(er)

0 kommentar(er)